Introduction

The Fintech industry is considered one of the fastest-growing industries in the world. As the solutions evolve, businesses are leveraging Fintech to improve their processes and offer financial inclusivity to the public. In this article we will discuss the trends that are shaping Fintech and its impact on the global market.

As of 2023, the Fintech industry was valued at $226.76 billion. According to financial experts and senior banking executives, non-traditional financial firms are making a massive impact on the financial industry, for example digital wallets and online payments. As more people use online banking systems, the Fintech industry is on the road of continuous growth, globally. Let’s look at how traditional banking has evolved over the years.

| Aspect | Traditional Banking | Fintech Industry Trends |

| Accessibility | Limited to physical branches and business hours | 24/7 access via mobile apps and online platforms |

| Customer Experience | In-person service, longer wait times | Instantaneous service, personalized user experience |

| Transaction Speed | Slow processing times, especially for international transactions | Real-time processing, instant cross-border payments |

| Cost of Services | Higher fees for transactions and account maintenance | Lower fees, often with no minimum balance requirements |

| Loan Approval Process | Lengthy, paper-based process requiring extensive documentation | Quick, digital application process using alternative credit scoring |

| Payment Methods | Cash, checks, and physical cards | Digital wallets, contactless payments, cryptocurrencies |

| Financial Inclusion | Limited access for underserved populations | Greater accessibility for underbanked and unbanked populations |

| Investment Opportunities | Restricted to traditional investment products | Access to robo-advisors, peer-to-peer lending, crowdfunding |

| Security Measures | Basic authentication methods, higher susceptibility to fraud | Advanced biometrics, AI-driven fraud detection, blockchain technology |

In this article, we will discuss the Fintech industry trends and how the Fintech software development market is going to change the future of Fintech in the coming years.

How is Fintech Changing the Way We Manage Money?

The Fintech industry is redefining how we make and save money. With the help of Fintech solutions, people can now make easier payments, invest in a diverse portfolio without any hassle that is otherwise seen in traditional banking systems, and save money in passive ways.

This industry is aiming to give consumers the convenience that is necessary in the digital age. The following points will discuss how Fintech affects the future of loans and investments, savings and other financial activities.

Enhanced Accessibility & Convenience

Previously, certain regions had limited access to traditional banking systems. With the help of the Fintech industry trends, consumers can now access financial services anytime and anyplace by simply using their smartphone or other devices.

Personalised Financial Management

AI and big data play a huge role in the growth of Fintech companies. With the help of this, the Fintech industry offers personalised management tools and provide financial advice. AI and big data can help organisations analyse aspects of consumers such as spending habits, goals and income to create tailored saving plans that are not seen in traditional banking.

Digital Payments & Mobile Banking

The use of online banking is common for most financial transactions. Fintech has streamlined the process of making payments and managing accounts. Mobile banking apps enable users to transfer money, pay bills, and monitor transactions in real-time, reducing the reliance on physical bank branches and cash.

Digital Wealth Management

Investment opportunities are often seen as a tool for the wealthy but with the help of Fintech platforms, this practice has been democratised. Now, a large part of the population can start investing in several investment opportunities ranging from stocks and bonds to cryptocurrencies, with lower fees and minimum investments. This has also given the rise to robo-advisors which offer automated, algorithm-driven financial planning services, making wealth management more accessible to the public.

Peer-to-Peer Lending (P2P) & Crowdfunding

Fintech has introduced new ways to access credit through P2P lending platforms, where individuals can borrow directly from other individuals without the need for traditional financial institutions. This is taken a step further with the help of crowdfunding platforms which enable entrepreneurs to raise capital directly from a large number of investors. Both these platforms are allowing people to inject money in the economy that was otherwise unused.

Cryptocurrency & Blockchain

The past decade has seen a major hype in blockchain technology and cryptocurrency trading. With the help of Fintech solutions, consumers now enjoy decentralized, secure, and transparent ways to conduct transactions. These innovations are reducing the need for intermediaries and lowering transaction costs.

Improved Security & Fraud Detection

As people build awareness for cybersecurity, globally, advanced Fintech solutions are employing robust security measures, such as biometrics, encryption, and machine learning algorithms, to enhance security of financial transactions and detect fraudulent activities more effectively.

Financial Inclusion

Fintech is playing a crucial role in promoting financial inclusion by providing affordable financial services to underserved and unbanked populations. Mobile money services, for instance, have empowered millions of people in developing countries to participate in the financial system.

Real-Time Data & Analytics

Fintech platforms offer real-time data and analytics, allowing users to make informed financial decisions. Access to up-to-date information on spending, budgeting, and investment performance helps individuals manage their finances more effectively.

Regulatory Technology (RegTech)

Fintech companies are also innovating in compliance and regulation. RegTech solutions use technology to streamline compliance processes, reduce regulatory risks, and ensure that financial institutions adhere to legal standards efficiently.

Financial Education

Many Fintech platforms incorporate educational resources to help users improve their financial literacy. Interactive tools, calculators, and informative content empower users to understand complex financial concepts and make better financial decisions.

Fintech Trends that will Shape the Future

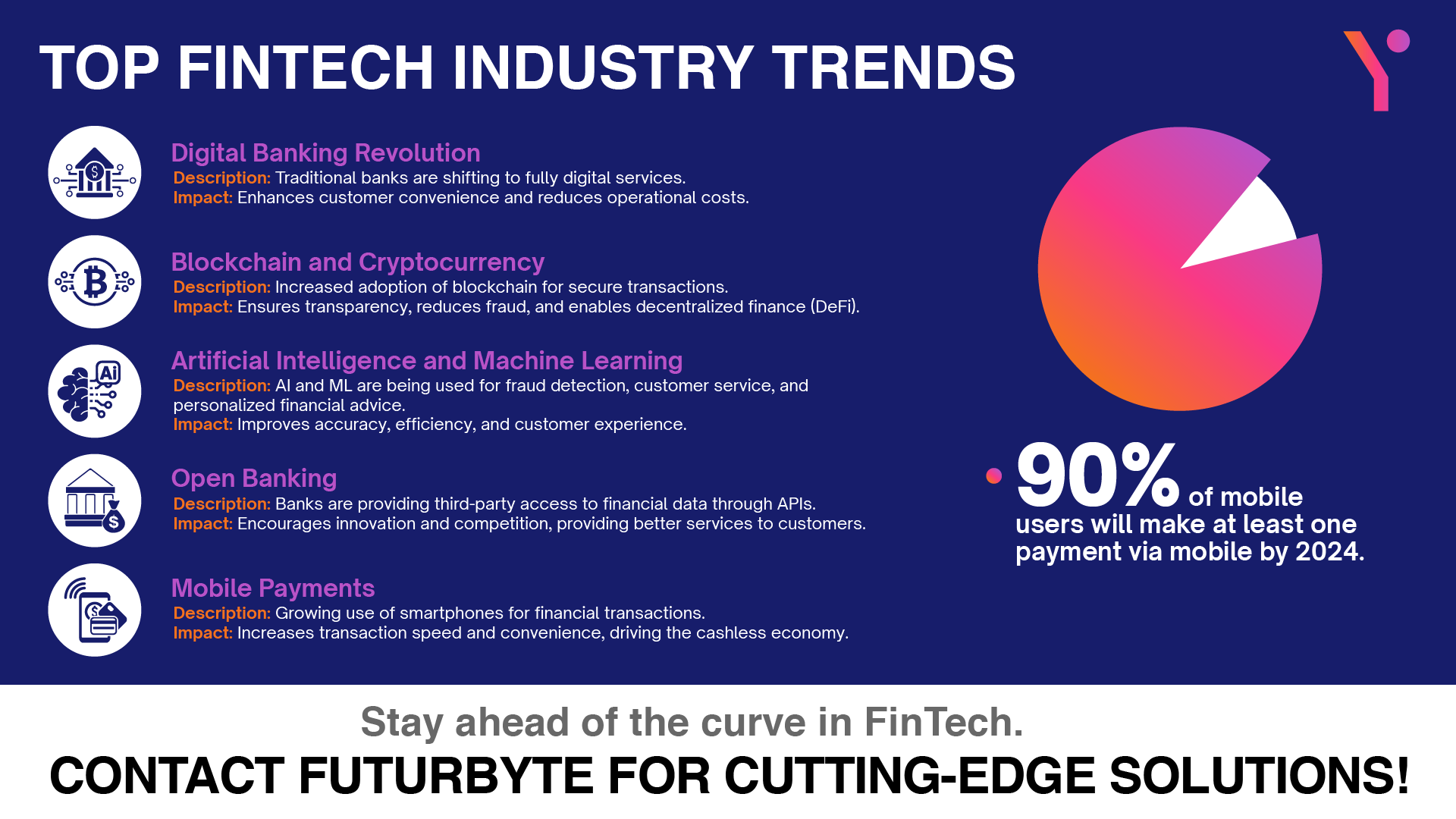

In the last five years, we have seen how Fintech is shaping the current era and its impact on industries across the world. Following are some of the trends that are expected to see in the coming years and how it can make an impact on the global economy:

More Fintech App Users

The number of users adopting Fintech apps is expected to surge as digital financial services become more mainstream. According to a report by Juniper Research, the number of global Fintech app users is projected to exceed 2 billion by 2024.

This growth is driven by the increasing reliance on mobile devices, greater internet penetration, and the convenience offered by Fintech solutions. Fintech apps provide a range of services from mobile banking to investment management, appealing to a broad demographic.

Increased Financial Stability

A study by EY suggests that 64% of consumers believe that Fintech solutions have positively impacted their financial well-being by improving their ability to manage finances and save money.

By providing tools for budgeting, saving, and investing, Fintech companies help users manage their money more effectively. Additionally, Fintech solutions offer access to credit and insurance products that were previously unavailable to underserved populations, fostering economic stability and growth.

Emerging Payment Technologies

Emerging payment technologies such as contactless payments, digital wallets, and blockchain-based transactions are transforming the way people conduct financial transactions. According to studies, contactless payments are projected to increase significantly, with 76% of global card payments expected to be contactless by 2027.

These technologies offer faster, more secure, and more efficient payment methods, reducing the reliance on cash and traditional banking processes.

Increased Bank Payment Usage

A report by Accenture found that digital payment transactions in the banking sector are expected to reach $8 trillion annually by 2025.

Despite the rise of non-bank Fintech solutions, banks are seeing increased usage of their digital payment services as they adopt Fintech industry trends. Traditional banks are integrating advanced payment technologies into their services to compete with Fintech startups, offering features like real-time payments and enhanced security measures.

Innovation in Personal Financial Management

Innovations in personal financial management (PFM) tools are empowering users to take control of their finances with greater ease and insight. The global personal finance software market is expected to reach $1.57 billion by 2027, growing at a CAGR of 5.8% from 2020 to 2027, according to Grand View Research.

These tools use AI and machine learning to provide personalized financial advice, track spending habits, and automate savings and investments.

Improved Identity Solutions

According to MarketsandMarkets, the global identity verification market is projected to grow from $7.6 billion in 2020 to $15.8 billion by 2025, at a CAGR of 15.6%. As the intensity and occurrence of cybersecurity threats increase, so does the need for robust security measures in digital financial transactions.

The Future of Fintech: Concluding Remarks

The future seems bright for the Fintech industry trends as more people are moving towards digital solutions for their financial activities. As the world moves towards digitising their processes, adopting these trends is seen as a huge boost to organisations globally. We are already seeing Fintech solutions for small businesses and large conglomerates making a difference in the way their business expands.

If you are looking for a Fintech software development company that will help you create a solution that help you further your cause, FuturByte has got you covered. Partner with us and get a free consultation to see how Fintech software development can benefit your business.

Frequently Asked Questions

Fintech trends are pushing traditional financial institutions to innovate and adopt new technologies. Banks and financial services companies are increasingly collaborating with Fintech firms, investing in digital transformation, and developing their own Fintech solutions to remain competitive.

Individuals and businesses can stay informed about Fintech trends by following industry news, subscribing to Fintech publications, attending industry conferences and webinars, and participating in online forums and discussions. Keeping up with the latest developments helps them leverage Fintech innovations to their advantage.

Fintech companies enhance financial stability by providing tools for better financial planning, automated savings, personalized investment advice, and more accessible credit options. These innovations help users manage their finances more effectively and build a more secure financial future.

The Fintech industry is currently experiencing several key trends, including the rise of Fintech app users, the adoption of emerging payment technologies, the use of alternative credit scoring methods, increased usage of bank payments through Fintech solutions, innovations in personal financial management, and improved identity solutions.

Have questions or feedback?

Get in touch with us and we‘l get back to you and help as soon as we can!