Introduction

Financial institutions are quickly understanding the importance of moving away from isolated silos and move to seamless digital transformation. This article will help you understand the importance of digitising and a blueprint to help you plan the process.

Digital transformation is becoming a necessity for financial businesses that are looking to improve and streamline their operations. This is because the growing regulatory complexities and the rising demand of customers amidst the competition leaves financial service businesses with no choice. To give you a better perspective, there are currently over 377 million accounts, globally, processing upwards of $936 billion in payments.

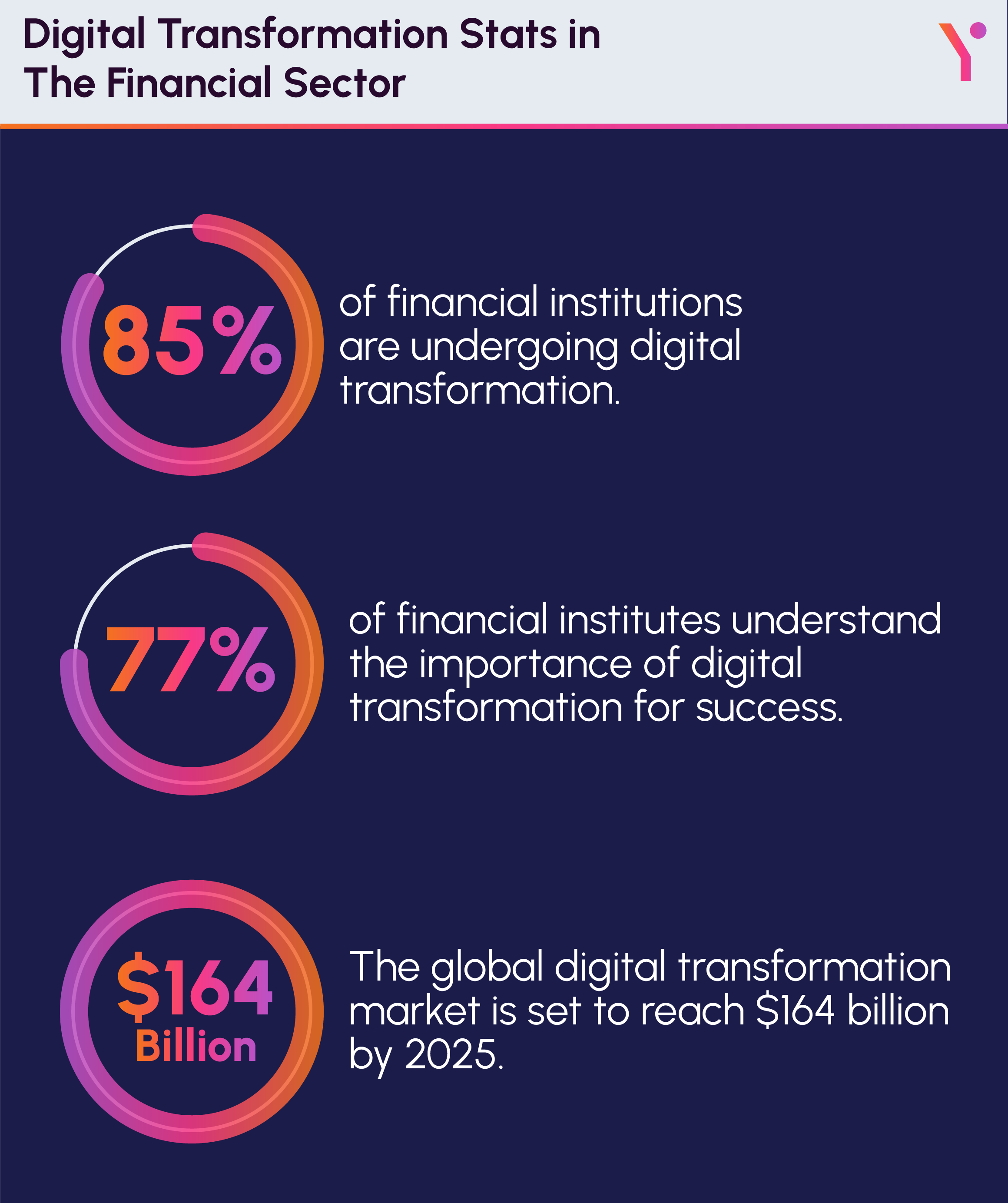

Digital Transformation Stats in The Financial Sector

- 85% of financial institutions are undergoing digital transformation

- 77% of financial institutes understand the importance of digital transformation for success

- The global digital transformation market is set to reach $164 billion by 2025

These numbers alone should be reason enough for financial institutions to start moving towards digital transformation to unlock new revenue streams and enhance operational efficiency, reshaping the financial industry for the future.

In this article we will discuss the benefits of digital transformation, the step-by-step approach of achieving this and key considerations to keep in mind during fintech software development.

The Silo Problem in Financial Services

Banks and financial institutions have access to a lot of customer information ranging from income, assets and credit score. That being said, all these information is stored in different silos that prevent these institutions to provide customers with a top-notch experience.

Due to the information being disjointed because of isolated silos, it can lead to challenges for both the institution and the customer. Data within these silos is not easily accessible or shareable within the organisation. This leads to inefficiencies due to the lack of collaboration.

Furthermore, due to the lack of alignment, data within solos can often be duplicated, inconsistent and inaccurate. When different departments are required to maintain their own copies, changes to the data will not be reflected through all department, leading to confusion and errors.

With the current era rapidly evolving, financial institutions need address information data silos ensuring a more unified view of customer information. This will enable better decision-making, personalised services, and improved customer experience.

Businesses can opt to hire a Python programmer, a Magento programmer, or opt for a custom PHP website development company to fast track their path to digital transformation.

Why Seamless Matters

Moving towards digitising the financial institutions can have several benefits that can help both employees and customers. Following are some of the major benefits digital transformation has to offer.

Improved Customer Experience

Digital transformation enables financial institutions to offer personalised and seamless customer experiences across channels. Features such as mobile banking apps, online account management, and chatbots enhance convenience and accessibility for customers.

Enhanced Operational Efficiency

Automation of manual processes, adoption of cloud-based solutions, and implementation of advanced analytics tools streamline operations and reduce administrative overhead. This leads to cost savings and allows staff to focus on higher-value tasks.

Better Risk Management

Advanced analytics and machine learning algorithms help financial institutions to assess and mitigate risks more effectively. Real-time monitoring of transactions and predictive analytics aid in identifying fraudulent activities and compliance violations.

Increased Productivity

Digital tools and technologies enable employees to collaborate more efficiently, access information quickly, and make data-driven decisions. This leads to improved productivity and better resource utiliation across the organisation.

Faster Time to Market

Agile development methodologies and cloud-based infrastructure facilitate rapid deployment of new products and services. Financial institutions can quickly respond to market demands, launch innovative solutions, and stay ahead of competitors.

Expanded Market Reach

Digital channels and online platforms allow financial institutions to reach a broader audience, including underserved markets. This enables them to attract new customers, expand their market share, and increase revenue opportunities.

Compliance and Security Enhancements

Digital transformation initiatives often include investments in cybersecurity measures and compliance frameworks. Implementing robust security protocols and adhering to regulatory requirements build trust with customers and regulators, ensuring data privacy and protection.

Data-Driven Insights

Digital transformation enables financial institutions to collect, analyse, and leverage vast amounts of data to gain actionable insights. By understanding customer behaviour, market trends, and operational performance, organisations can make informed decisions and drive business growth.

Innovative Financial Products and Services

Digital transformation fosters innovation by enabling the development of new financial products and services. This includes digital wallets, robo-advisors, peer-to-peer lending platforms, and blockchain-based solutions, which cater to evolving customer needs and preferences.

Adaptability to Market Changes

Financial institutions that embrace digital transformation are better equipped to adapt to market changes and disruptions. They can quickly pivot their strategies, adjust offerings, and capitalise on emerging opportunities, ensuring long-term resilience and sustainability.

Digital Transformation Blueprint for Financial Services

So, how can financial institutions embark on their digital transformation journey? Here’s a blueprint:

Develop a Clear Vision and set clear goals

Outline a comprehensive vision for digital transformation. Understand the objectives, desired outcomes, and digital technologies’ role in achieving them.

Assess Digital Maturity

Evaluate your current digital capabilities and maturity. Identify strengths and weaknesses in your organisation’s technology infrastructure, workforce skills, and digital culture.

Identify Priorities

Determine critical areas that require transformation and prioritise initiatives accordingly. Consider factors such as customer needs, competitive landscape, and regulatory requirements.

Establish a Roadmap

Create a detailed implementation plan using roadmap templates, considering technology adoption and cultural change. A well-defined roadmap should outline each initiative’s timeline, resource allocation, and milestones.

Training and Skill Development

Invest in training programs to equip your team with the skills and knowledge to effectively utilise new technologies. Ensure your workforce is well-prepared to navigate the digital landscape.

Innovative Culture

Foster a culture of innovation within your organisation to sustain and adapt to digital transformation. Encourage employees to embrace change, experiment with new technologies, and continuously improve processes.

Key Considerations

Digital transformation is seen as a complex process within the financial sector which requires careful planning. Here are some key considerations to keep in mind when creating an execution plan.

Customer-Centric Approach

Prioritise the needs and preferences of customers throughout the digital transformation journey. Understand their pain points, preferences, and expectations to design solutions that enhance their experience and satisfaction.

Data Security and Compliance

Ensure robust cybersecurity measures are in place to protect sensitive financial data and customer information. Adhere to regulatory requirements such as GDPR, PCI DSS, and PSD2 to maintain compliance and build trust with customers.

Technology Infrastructure

Invest in scalable and flexible technology infrastructure that can support the digitalisation of banking operations. Embrace cloud computing, microservices architecture, and API-driven integrations to enable agility, scalability, and interoperability.

Talent and Skills Development

Develop a workforce with the necessary digital skills and expertise to drive innovation and digital transformation initiatives. Invest in training programs, reskilling, and upskilling to empower employees to adapt to new technologies and workflows.

Partnerships and Ecosystem Collaboration

Foster collaboration with fintech startups, technology vendors, and industry partners to leverage their expertise and accelerate innovation. Explore strategic partnerships and alliances to co-create solutions and address market opportunities.

Regulatory Landscape

Stay abreast of evolving regulatory requirements and compliance standards governing the financial services industry. Proactively monitor regulatory changes and adapt internal policies and procedures to ensure compliance and mitigate risk.

User Experience Design

Design intuitive and user-friendly digital interfaces for banking applications, websites, and mobile platforms. Prioritise usability, accessibility, and responsiveness to deliver seamless and engaging experiences for customers across channels.

Data Analytics and Insights

Leverage advanced analytics, machine learning, and artificial intelligence to extract actionable insights from vast amounts of financial data. Use predictive analytics to anticipate customer needs, identify market trends, and personalise offerings.

Change Management and Culture Shift

Foster a culture of innovation, agility, and continuous improvement to support digital transformation initiatives. Encourage open communication, collaboration, and experimentation to drive cultural change and overcome resistance to change.

Measuring Success and ROI

Define clear metrics and KPIs to track the progress and impact of digital transformation initiatives. Monitor key performance indicators such as customer satisfaction, operational efficiency, revenue growth, and market share to measure success and demonstrate ROI.

The Future of Financial Services

Businesses are leveraging technological advancements and digital transformation to help them streamline their processes. This trend is set to grow in the coming years and the future of financial services looks promising.

Shift Towards B2B2C Focus

Digital transformation is driving a shift in focus towards a B2B2C (business-to-business-to-consumer) model in the financial sector. This approach involves collaborating with business partners to deliver seamless and personalised experiences to end customers. By forming strategic partnerships with fintech startups, technology providers, and other industry players, financial institutions can enhance their product offerings, expand their market reach, and improve customer engagement.

Through APIs and open banking initiatives, banks and financial services firms can integrate their services with third-party platforms and applications, enabling customers to access a broader range of financial products and services conveniently.

Internet of Things (IoT) Opportunities

The Internet of Things (IoT) presents significant opportunities for innovation and growth in the financial sector. IoT devices such as wearables, connected cars, and smart home appliances generate vast amounts of data that can be leveraged to gain insights into consumer behavior, preferences, and lifestyle patterns.

Financial institutions can use this data to personalise offerings, mitigate risk, and enhance customer experiences. For example, insurers can offer usage-based insurance policies tailored to individual driving habits, while banks can provide personalised financial advice based on real-time spending patterns and financial goals.

XaaS Dominance Over In-House Solutions

As digital transformation accelerates, financial institutions are increasingly embracing XaaS (Everything-as-a-Service) models over traditional in-house solutions. XaaS offerings such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) provide greater flexibility, scalability, and cost-effectiveness compared to on-premises software and hardware deployments.

By adopting cloud-based solutions, financial firms can streamline operations, reduce IT overhead, and rapidly deploy new services to market. Moreover, XaaS providers often offer built-in security features, compliance capabilities, and regular updates, helping organisations stay ahead of evolving threats and regulatory requirements.

Privacy Concerns as an Existential Threat

Privacy concerns pose an existential threat to the future of the financial sector amidst digital transformation. As financial institutions collect and analyse vast amounts of customer data to deliver personalised experiences and drive decision-making, they must prioritise data privacy and security to build trust and maintain regulatory compliance. Heightened scrutiny from regulators, increased consumer awareness, and high-profile data breaches have underscored the importance of safeguarding sensitive information and respecting user privacy rights.

Financial firms must invest in robust cybersecurity measures, implement data protection controls, and adhere to privacy regulations such as GDPR, CCPA, and PSD2 to mitigate risks and protect customer trust. Additionally, organisations should prioritise transparency, accountability, and ethical data practices to address privacy concerns and foster consumer confidence in the digital economy.

Conclusion

As the world moves towards digital transformation, the financial sector needs to be the first in line. With advancements in the financial sector growing, it is becoming a necessity for businesses in this sector to ensure a streamlined process.

If you are looking towards getting a digital transformation for your organisation, FuturByte is your best bet. Contact us today for a free consultation. From solutions to cross platform mobile app development, we will help you through all the challenges of digital transformation.

Frequently Asked Questions

Digital transformation is important for financial institutions to stay competitive in a rapidly evolving market, meet changing customer expectations, reduce costs, and mitigate risks. It enables them to adapt to technological advancements, improve service delivery, and capitalize on new business opportunities.

Key drivers of digital transformation in the financial sector include changing customer preferences, advances in technology (such as AI, blockchain, and cloud computing), regulatory requirements, competition from fintech startups, and the need to improve operational efficiency.

Common digital transformation initiatives in the financial sector include the adoption of mobile banking apps, implementation of AI and machine learning for data analytics and fraud detection, development of robo-advisors for investment management, deployment of blockchain for secure transactions, and adoption of cloud computing for scalability and cost-effectiveness.

Digital transformation enhances customer experiences in the financial sector by enabling convenient access to services through digital channels, personalized interactions, faster transaction processing, 24/7 availability, and self-service options such as online account management and mobile payments.

Challenges associated with digital transformation in the financial sector include legacy IT systems, data security and privacy concerns, regulatory compliance, talent shortages, cultural resistance to change, and the need for significant investment in technology and infrastructure.

Have questions or feedback?

Get in touch with us and we‘l get back to you and help as soon as we can!