Why entrust sensitive data to third-party apps when you can have it all in your hands? No more security concerns; build a super finance app tailored just for professionals!

Ever find yourself drowning in receipts and spreadsheets, wishing you had a money-managing application that leaves behind all the hassle and provides a tool that keeps all your financial needs in check? Well, good news! Developers from around the world have produced some incredible apps that can turn you into a financial superhero. Let’s ditch the stress and find out the best apps for finance professionals in 2025!

NOTE: This blog is for informational purpose, we don’t promote any of the applications listed below!

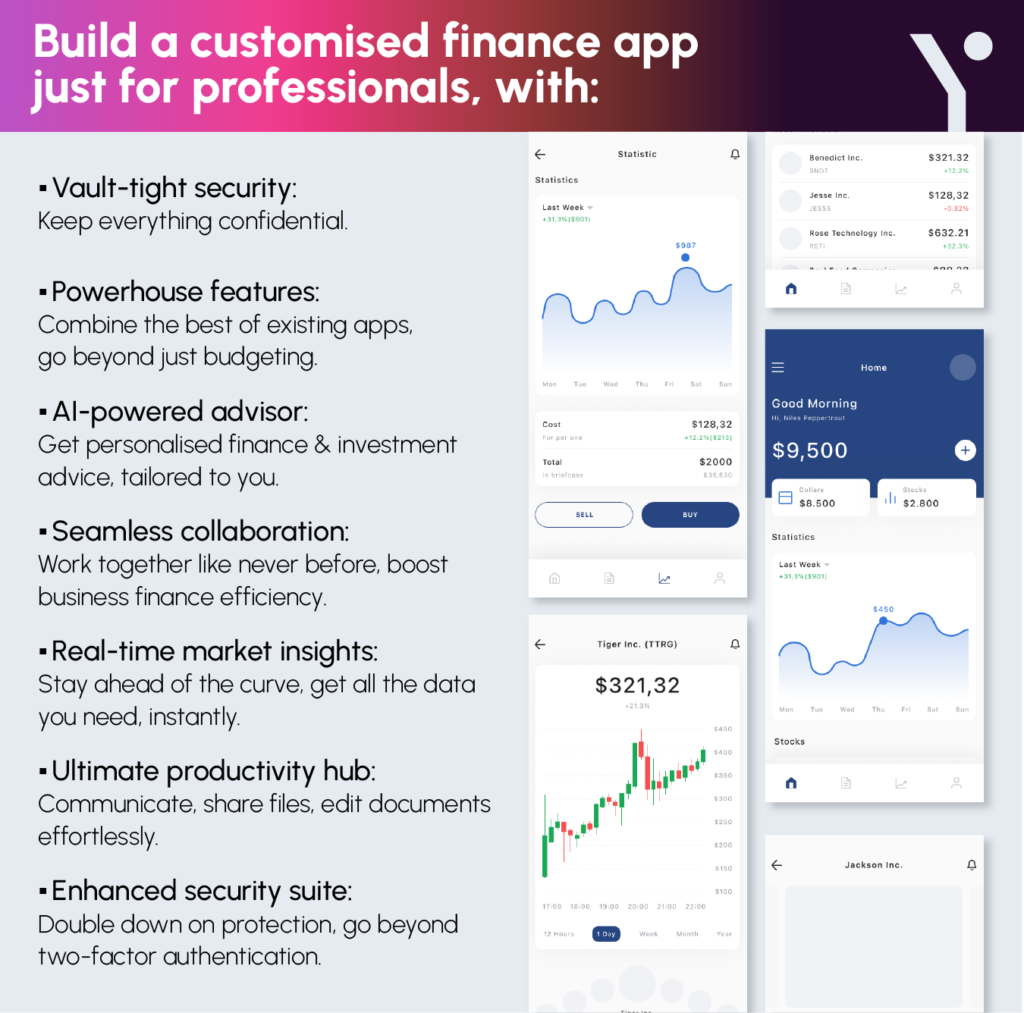

The Ultimate Finance App for Professionals

As businesses increasingly rely on third-party apps, the need for robust data security has never been more critical. Entrepreneurs and companies must address the concerns surrounding the integrity of financial data. Building a customised finance app allows for tailored security measures, ensuring that sensitive data remains confidential and protected against potential breaches.

A super app might become essential for finance professionals by combining the capabilities of existing tools and bridging gaps. Data integrity is just one part of developing a finance app; you need a lot more options to stay ahead in the ever-changing environment.

Are you an entrepreneur or company seeking to tap into the ever-growing market of finance apps? The opportunities are boundless, and the demand for innovative solutions is higher than ever. As finance professionals increasingly rely on digital tools to streamline their processes, here are some potential areas where your app could make a significant impact.

Automated Financial Planning

Develop an app that takes financial planning to the next level. An all-in-one solution that not only budgets but also automates savings suggests personalised financial goals and provides real-time optimisation tips can be a game-changer.

AI-Driven Investment Adviser

Create an app that leverages artificial intelligence to offer personalised investment advice. Tailor recommendations based on users’ financial goals, risk tolerance, and market trends. An intuitive interface and transparent decision-making process can attract both novice and seasoned investors.

Remember, creating the best apps for finance professionals in 2025 is all about doing what others are lacking in terms of providing finance-related services!

Business Finance Collaboration

Build a collaborative platform specifically designed for businesses. Integrating features from QuickBooks or Xero with enhanced collaboration tools could revolutionise how businesses handle their finances, especially in multi-user environments.

Real-Time Market Insights

In the competitive landscape of market data apps, consider developing a platform that combines the strengths of Bloomberg and Reuters. Deliver real-time market data, analytics, and news in a user-friendly interface, making it accessible to a broader audience.

Advanced Productivity Hub

Take inspiration from Slack, Google Drive, and Dropbox, and create an app that becomes the ultimate productivity hub for finance professionals. Seamless communication, file sharing, and collaborative document editing could redefine how finance teams work together.

Enhanced Security Suite

Given the critical nature of financial data, there’s always room for improvement in security apps. Develop an advanced security suite that not only handles two-factor authentication but also incorporates cutting-edge encryption techniques, providing an extra layer of protection.

These opportunities represent just 10% of what you can produce with a custom mobile app development for professionals. You can address specific pain points or introduce unique features to them. Your finance app could become the next must-have tool in the industry. So, seize the moment, innovate, and create a solution that transforms the way finance professionals manage their work in 2025 and beyond.

Budgeting & Expense Tracking

The major chunk goes to budgeting and expense tracking when we talk about finance apps; managing your money effectively is non-negotiable. Budgeting apps like YNAB (You Need a Budget) and Mint make this process a breeze. They help you track your expenses, set financial goals, and ensure every dollar has a purpose. For finance professionals, these apps are the backbone of smart financial decision-making, providing clarity and control over personal and professional finances.

YNAB (You Need a Budget)

YNAB stands out for its user-friendly interface and proactive budgeting approach. It encourages users to assign every dollar a job, ensuring a comprehensive financial plan. The app’s real-time syncing keeps your budget up-to-date across devices. YNAB is perfect for finance professionals who prefer a hands-on approach to budgeting and want a tool that actively helps them allocate funds effectively.

| Pros | Cons |

| User-friendly interface | Subscription fee may be a deterrent |

| Real-time syncing across devices | Learning curve for new users |

Mint

Mint is a versatile budgeting app that automatically categorises transactions, making it a time-saver for busy finance professionals. It provides insights into spending patterns and alerts for bill reminders. Mint’s visual representations of financial data help users grasp their financial health quickly. It’s suitable for professionals who want a well-rounded budgeting tool with automated features and a visually intuitive dashboard.

| Pros | Cons |

| Automatic transaction categorisation | Ads and product recommendations may be intrusive |

| Insights into spending patterns | Limited investment tracking features |

Investing & Trading

For finance professionals looking to grow their wealth, investing and trading apps like Robinhood and Acorns are game-changers. Robinhood’s simplicity makes it ideal for beginners, while Acorns allows you to invest spare change effortlessly. These apps democratise investing, allowing professionals to take control of their financial future, regardless of their experience level.

Robinhood

Robinhood is a popular commission-free trading platform known for its simplicity. It’s ideal for finance professionals who are new to investing or prefer a straightforward approach. The app’s clean design and easy navigation make it accessible for beginners. Robinhood’s fractional shares feature is advantageous for those who want to invest smaller amounts in high-priced stocks.

| Pros | Cons |

| Commission-free trading | Limited research tools compared to other platforms |

| Fractional shares feature | Customer service concerns in the past |

Acorns

Acorns differs from other investing apps since it uses any extra change from regular purchases. This micro-investment strategy is perfect for finance professionals looking to passively grow their wealth. The app’s diversified portfolio options cater to varying risk appetites. Acorns is particularly beneficial for those who want to start investing without actively managing their portfolio.

| Pros | Cons |

| Round-up purchases for investing | Monthly fee for Acorns Personal |

| Diversified portfolio options | Limited control over investment choices |

Financial Planning & Goal Setting

Empower and Personal Capital go beyond budgeting, offering comprehensive financial planning. As a finance professional, setting and achieving long-term financial goals is paramount. These apps analyse spending patterns, suggest savings goals, and provide personalised tips, ensuring you’re on track for financial success.

Empower

Empower is a holistic financial planning app that goes beyond budgeting. It analyses spending patterns, suggests savings goals, and offers personalised tips for financial optimisation. With its automated savings feature, Empower is suitable for finance professionals who want a comprehensive solution for both short-term budgeting and long-term financial planning.

| Pros | Cons |

| Holistic financial planning | Some features may require a subscription |

| Analyses spending patterns | Integration with external accounts may have limitations |

Personal Capital

A wealth management tool, Personal Capital provides a 360-degree view of all your financial expenses. It incorporates budgeting, investment tracking, and retirement planning. Financiers who are concerned about their financial stability, in the long run, will find it indispensable due to its comprehensive retirement planner and net worth tracker. Those who have a broad spectrum of investments can benefit from Personal Capital app.

| Pros | Cons |

| 360-degree view of financial life | High minimum investment for advisory services |

| Budgeting, investment tracking, and retirement planning | Some features may require a subscription |

Business Finance & Accounting

For those handling business finances, QuickBooks and Xero are indispensable. They streamline invoicing, expense tracking, and tax preparation. More than just numbers, these apps empower finance professionals to make informed decisions, ensuring the financial health of the business.

QuickBooks

QuickBooks is a staple in business finance, offering comprehensive accounting features. It caters to small businesses and freelancers, streamlining invoicing, expense tracking, and tax preparation. QuickBooks is must-have app for finance professionals as it handles business finances, providing real-time insights and aiding in financial decision-making.

| Pros | Cons |

| Comprehensive accounting features | Learning curve for advanced features |

| Real-time insights for business finances | Pricing can be higher compared to competitors |

Xero

Xero is a cloud-based accounting solution known for its collaboration features. It allows multiple users to work simultaneously on financial data, making it suitable for finance professionals working in collaborative environments. Xero’s user-friendly interface and seamless integration with other business apps make it a go-to choice for efficient financial management.

| Pros | Cons |

| Cloud-based accounting solution | Might not be as feature-rich for larger businesses |

| Simultaneous work on financial data | Some integrations may have limitations |

Market Data & News

Finances require data and the latest news; therefore, being informed is key for finance professionals. Bloomberg and Reuters deliver real-time market data and news, aiding finance professionals in making timely decisions. Whether you’re a trader, analyst, or financial journalist, these apps provide the insights needed to stay ahead of the curve.

Bloomberg

Bloomberg is a powerhouse for financial professionals seeking in-depth market data and news. It offers real-time information, analytics, and a platform for financial analysis. Bloomberg is indispensable for professionals who rely on accurate and timely market updates, making it a common choice among traders, analysts, and financial journalists.

| Pros | Cons |

| In-depth market data and news | Steeper learning curve for new users |

| Platform for financial analysis | Expensive subscription fees |

Reuters

Reuters is a global news organisation providing reliable financial news. While not as comprehensive as Bloomberg, Reuters is accessible and offers a broader range of news topics. It’s suitable for finance professionals who need timely news updates and insights into global economic trends.

| Pros | Cons |

| Reliable global financial news | Less comprehensive than Bloomberg |

| Accessible and broad range of topics | Limited analysis tools |

Productivity & Collaboration

Finance is often a team effort, and apps like Slack, Google Drive, and Dropbox facilitate seamless collaboration. These tools enhance communication, file sharing, and document management, ensuring that finance professionals can work together efficiently and productively.

Slack

Slack is a communication powerhouse for finance professionals working in teams. Its real-time messaging, file sharing, and integration capabilities streamline collaboration. With channels dedicated to specific topics or projects, Slack enhances communication efficiency. Finance teams can benefit from quick updates, file sharing, and integrations with other productivity tools.

| Pros | Cons |

| Real-time messaging and file sharing | Limited functionality in the free version |

| Channels for specific topics or projects | Can be overwhelming for small teams |

| Quick updates and communication efficiency | Integrations with other tools |

Google Drive/Dropbox

Both Google Drive and Dropbox are essential for document management and collaboration. Google Drive’s real-time editing and cloud-based storage facilitate seamless collaboration on spreadsheets, documents, and presentations. Dropbox, known for its file-sharing simplicity, is ideal for finance professionals who prioritise ease of use and need a reliable cloud storage solution.

| Pros | Cons |

| Real-time editing and cloud-based storage | Limited free storage capacity |

| Accessibility from any device | Dropbox may have better file-sharing simplicity |

Security & Authentication

Security is of the utmost importance in the banking industry. Apps like 1Password, Google Authenticator, LastPass, and Authy provide additional protection. These applications are designed to assist finance professionals in managing their accounts, preventing unauthorised individuals from accessing critical financial information.

Google Authenticator/Authy

Two-factor authentication is crucial for securing financial accounts. Google Authenticator and Authy provide an additional layer of security by generating time-sensitive codes. Finance professionals handling sensitive information should use these apps to enhance account protection. Authy’s advantage lies in its ability to sync across multiple devices, providing flexibility without compromising security.

| Pros | Cons |

| Two-factor authentication | Setup process can be tedious for some |

| Time-sensitive code generation | No account recovery options if device is lost |

LastPass/1Password

Password management is paramount in the finance sector. LastPass and 1Password store and generate complex passwords, ensuring accounts remain secure. LastPass’s strength lies in its user-friendly interface, while 1Password offers advanced features like secure document storage. Finance professionals can choose based on their preference for simplicity or additional features.

| Pros | Cons |

| Password management | Learning curve for advanced features |

| Securely stores and generates complex passwords | Some features may require a subscription |

Wrapping Up!

As we wrap up our look into the best apps for finance pros in 2025, one thing is clear: the future is full of possibilities! Entrepreneurs and businesses have a great chance to make a custom finance app that fits pros perfectly. A super app for finance can open doors to a future where data stays safe and handling finances becomes a breeze. So, get your idea and start on your dream finance application with FuturByte. Let’s cheer for an amazing financial year ahead!

Frequently Asked Questions

Have questions or feedback?

Get in touch with us and we‘l get back to you and help as soon as we can!